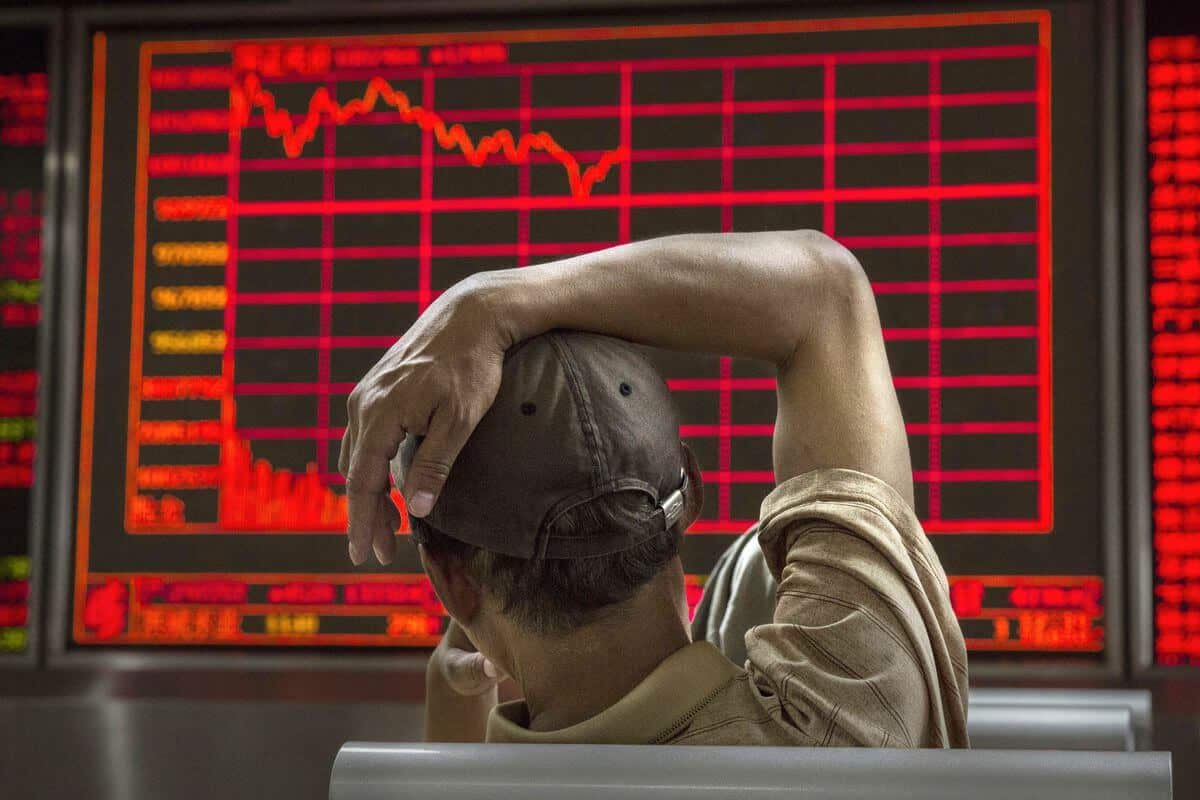

China Economic Slowdown Seemingly Affecting Consumer Spending

With China’s slowing economy, there is also a strolling fear from the consumer’s spending. Sluggish retail sales data, car sales, housing market, are all of them so to mention. But, many analysts disagree with this and say that the consumers will keep on spending in China.

On Monday, it was reported that the car automobile industry fell to 15.8 percent from 2.37 million in January. This marked the decline of sales in the world’s automobile market.

Li-gang Liu, the chief economist of Citigroup, China said that he has some expectation from Beijing to boost up this market.

And on Tuesday, he told CNBC’s “Squawk Box” that the impact of personal tax should also be considered, and once people are stabilized with their sentiments, the consumers will be happy to consume again.

Another Oxford Economist, Tianjie He said, the fears have been overstated while expecting the consumption growth to slow, and the anxiety’s largely overdone.

China’s service sector is kept up a strong pace of extension in January even though development directed marginally, the Caixin/Markit administrations obtaining supervisors’ list (PMI) appeared.

Moreover, offers of gold, silver, and gems climbed a year ago contrasted with 2017’s development rate, and extravagance organizations likewise revealed “better than average” expanded deals in China in 2018, he said.

All that recommends that “the uneasiness concerning China’s purchases, which is to a great extent dependent on melting away interest for autos, is probably going to be overcompensated.”

While China has gone on an upgrade drive to resuscitate its abating economy, a few investigators state the experts have not done what’s needed.

In any case, Barclays Chief China Economist Jian Chang said she anticipates that framework speculations should get amidst this year. That will help balance the impacts of the abating lodging business sector and land interest in the nation, and she told CNBC’s “Road Signs” on Monday.

More should be possible to open the “positive property value” that numerous Chinese family units have, Citigroup’s Liu stated, alluding to the genuine estimation of a property.

He said, on the off chance that Chinese banks can offer different items, for example, home value advances for individuals to pull back their positive value at an early stage, this could make huge utilization control in China.

Liu added provincial land changes in China could release a “riches impact” among country agriculturists. Not far off, China’s utilization potential is enormous.

Paula has recently joined the family of FinanceWhile News. She holds a master degree in Economics and holds vast experience in dealing with different types of content for print as well as digital media. When Paula is off work, you will find her engrossed in books and music.