Trump Media Buys 684M Cronos Tokens in $105M Cash-Stock Deal

Key Highlights:

- Trump Media has acquired 684 million Cronos.

- These tokens will be integrated into Truth Social as a part of reward systems.

- Trump Media can also stake the tokens using Crypto.com

Trump Media & Technology Group (TMTG), the company who is behind Truth Social, has acquired 684 million Cronos (CRO) tokens in a deal which is worth $105 million. This amount is being paid partly in cash and partly in stock. The media house will store its CRO tokens with Crypto.com Custody, which lets them stake the tokens to earn extra revenue, as confirmed in the official deal and press release. This is one of the largest direct cryptocurrency purchases made by a U.S. listed media company which showcases TMTG’s increasing interest in the blockchain industry.

A Bold Bet on Cronos

This move by Trump Media into the cryptocurrency industry also highlights its strategy to expand way beyond the traditional media space. The $105 million is being paid partly and in this way, the company is making sure that it does not drain all of its cash at once. If you look at it closely, it is actually a financial strategy to grow the company while keeping the resources stable and not taking risk at the moment.

With this purchase, Trump Media actually owns one of the largest corporate holdings of Cronos and we all know that holding a big chunk of tokens may allow the company to affect decisions, vote on proposals, or have an impact on how the network develops in the future.

Integrating Blockchain with Media Ambition

According to experts, this could be more than just an investment. Trump Media has been trying to make Truth Social more and more engaging and using blockchain could do exactly that. By investing in blockchain technology, it could open up opportunities such as token rewards, decentralized identity, or Web3 commerce.

With so many CRO tokens, Trump Media could be exploring loyalty programs for subscription, ad-revenue sharing, or NFT-based campaigns.

Timing and Market Context

Trump Media’s purchase has come at a time when more and more companies are adding cryptocurrencies to their treasuries. All of these companies are following the footsteps of Strategy (formerly known as MicroStrategy) which focuses on Bitcoin.

Cronos, on the other hand, is building itself as a multi-chain hub for DeFi, connecting with Ethereum and Cosmos, and daily activity on its blockchain is growing, all because of decentralized finance and payment use cases. A high-profile corporate investment like this could push Cronos with more credibility and attract big institutional investors.

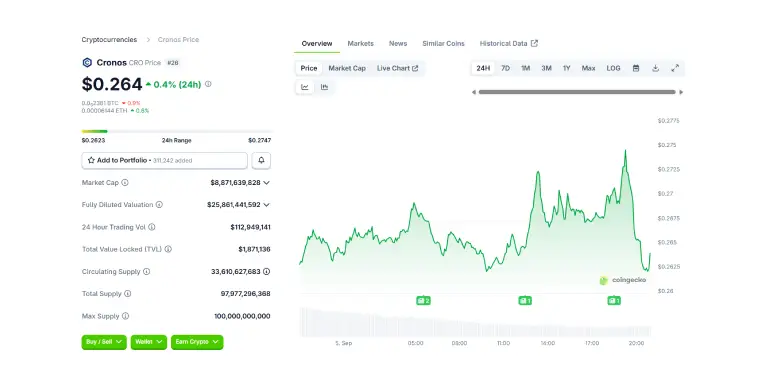

Once this news broke out, the price of the token experienced an uptick. At press time, the price of the token stands at $0.264 with an increase of 0.4% in the last 24 hours.

Potential Regulatory Scrutiny

Experts believe that a deal this big could bring in a lot of regulatory attention. As a publicly traded company, Trump Media may need to provide extra disclosures about how it values the tokens, how it keeps them safe, and the risks for shareholders. U.S. regulators have historically looked closely at media and tech firms moving into crypto.

As of now, the company has made it public that it is following all the existing financial reporting rules and hence there should not be any problems that are related to regulatory compliances.

Also Read: SEC and CFTC to Conduct Roundtable Meeting on Sept 29

Harsh Chauhan is an experienced crypto journalist and editor at CryptoNewsZ. He was formerly an editor at various industries, including his tenure at TheCryptoTimes, and has written extensively about Crypto, Blockchain, Web3, NFT, and AI. Harsh holds a Bachelor of Business Administration degree with a focus on Marketing and a certification from the Blockchain Foundation Program. Through his writings, he holds the pulse of the rapidly evolving crypto landscape, delivering timely updates and thought-provoking analysis. His commitment to providing value to readers is evident in every piece of content produced. With a deep understanding of market trends and emerging technologies, he strives to bridge the gap between complex blockchain concepts and mainstream audiences.