Roman Storm Case Enters Crucial Phase After Mixed Verdict

Key Highlights:

- Roman Storm was convicted of operating an unlicensed money transfer company.

- Two other charges were not agreed upon by the jury.

- Future legislation pertaining to crypto privacy tools may be influenced by this case.

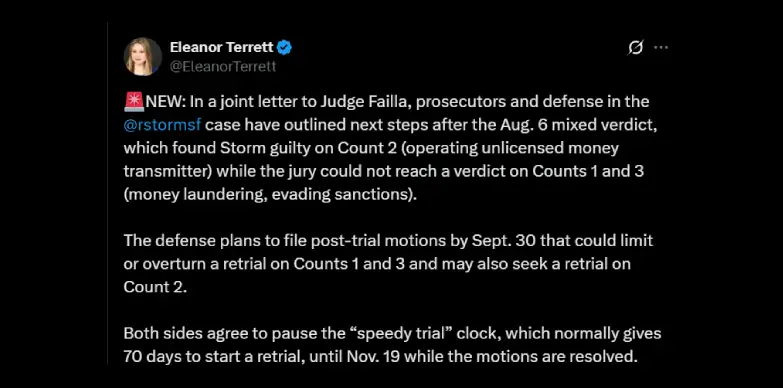

A crucial new stage in the widely followed case involving Roman Storm’s work on the Tornado Cash cryptocurrency platform has been marked by a new joint letter sent to U.S. District Judge Katherine Polk Failla by the defence and prosecution teams in the case of United States v. Roman Storm.

Mixed Jury Verdict Leads to Strategic Legal Maneuver

On August 6, 2025, after a closely watched trial in the Southern District of New York, a jury delivered on Count 2 for running an unlicensed money transfer business, but jurors could not agree on Counts 1 and 3, which accused him of money laundering and dodging U.S. sanctions. The results show how difficult it is to apply federal laws to rapidly evolving crypto technology.

At the centre of the case is Tornado Cash, a decentralized Ethereum-based mixer that hides where crypto comes from and where it is headed next. Supporters call it a vital privacy tool, but according to U.S. officials, this platform was misused by bad actors such as North Korea’s Lazarus Group, to wash off large sums, sparking national security alarms.

The joint letter reveals that Storm’s defence team plans to file major post-trial motions by September 30, 2025. These could contest the strength of the evidence on Count 2, contend that errors in the trial call for a new trial, or attempt to prevent a retrial on the unresolved charges.

It’s interesting to note that, in spite of the guilty verdict, they might even attempt to have Court 2 retired, indicating a daring attempt to weaken the strongest blow from the jury’s verdict. If they succeed, it could seriously undercut the government’s case.

Agreement to Pause Speedy Trial Clock

Both sides have agreed to pause the “speedy trial” clock until November 19, 2025. Normally, the Speedy Trial Act requires a retrial within 70 days after a mistrial, but hitting pause gives the court some time to go through the upcoming motions without racing against the clock.

In their filing, both parties have said that the motion “could affect the scope of the retrial” and that pausing the countdown serves “the end of justice.” This rare agreement shows just how tricky the unresolved issues are, and how much is on the line for both sides.

What’s Next?

The agreed schedule is as follows;

- September 30, 2025: Defense post-trial motions due.

- October 31, 2025: Prosecution response due.

- November 19, 2025: Status conference or court decisions, possibly establishing dates for retrials if required.

Implications Beyond the Courtroom

According to reporter Eleanor Terrett, the impact of these motions could reach far beyond Roman Storm’s case. If the defence succeeds in stopping a retrial on Counts 1 and 3, or overturning the guilty verdict on Count 2, it could send a clear message to privacy-focused crypto developers that courts may not always back aggressive government crackdowns. It could also push the Department of Justice to rethink its approach to targeting open-source blockchain projects.

Legal experts believe that Judge Failla’s decision will be an important one as it will set a standard as to how decentralized software creators are treated if they are found to be involved in cases of money laundering or sanctions violations.

For now, all eyes are on the September 30 deadline. What the defence puts forward in those filings will decide if this heads back to trial, gets drastically narrowed, or takes a turn no one saw coming.

Also Read: US to Press Ahead With Strategic Bitcoin Reserve: Bo Hines

Harsh Chauhan is an experienced crypto journalist and editor at CryptoNewsZ. He was formerly an editor at various industries, including his tenure at TheCryptoTimes, and has written extensively about Crypto, Blockchain, Web3, NFT, and AI. Harsh holds a Bachelor of Business Administration degree with a focus on Marketing and a certification from the Blockchain Foundation Program. Through his writings, he holds the pulse of the rapidly evolving crypto landscape, delivering timely updates and thought-provoking analysis. His commitment to providing value to readers is evident in every piece of content produced. With a deep understanding of market trends and emerging technologies, he strives to bridge the gap between complex blockchain concepts and mainstream audiences.