PayPal to Add Bitcoin and Ethereum Payments for Users

Key Highlights

- PayPal disclosed its plan to integrate cryptocurrencies like Bitcoin and Ethereum into its payment system

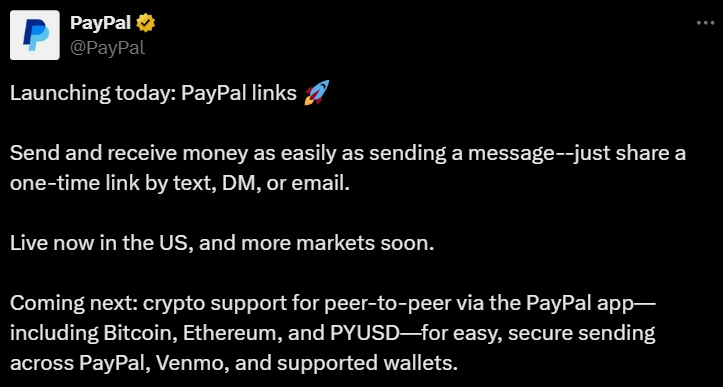

- PayPal introduces a new feature, called “PayPal links”, that allows users to send and receive money as easily as sharing a link in a text message or chat

- This announcement comes after the success of its stablecoin, PYUSD

On September 15, PayPal, the leading payment platform, announced that it will soon integrate cryptocurrency directly into its payment system.

(Source: PayPal)

This integration will enable users in the U.S. to easily send popular cryptocurrencies, such as Bitcoin and Ethereum, as well as PayPal’s own PYUSD stablecoin, to friends and family through a simple interface.

This service will work not only between PayPal and Venmo users but also with a growing number of digital wallets worldwide that support cryptocurrencies.

PayPal Introduces New Features

The payment giant has also announced a new revolutionary feature, called “PayPal links”, that allows users to send and receive money as easily as sharing a link in a text message or chat. This one-time payment link can be shared through any messaging platform, whether through WhatsApp, email, social media, or test messages.

This new feature is now available to users in the United States and will expand to the United Kingdom, Italy, and other markets later this month.

Diego Scotti, General Manager, Consumer Group at PayPal, said, “For 25 years, PayPal has revolutionized how money moves between people. Now, we’re taking the next major step. Whether you’re texting, messaging, or emailing, now your money follows your conversations. Combined with PayPal World, it’s an unbeatable value proposition, showing up where people connect, making it effortless to pay your friends and family, no matter where they are or what app they’re using.”

This announcement comes at a time when peer-to-peer payments are experiencing strong growth for PayPal, with a 10% increase in payment volume compared to last year.

Venmo, PayPal’s popular payment gateway, has also seen its highest growth in three years.

PayPal’s digital dollar, known as PYUSD, has emerged as a major success story in bringing cryptocurrency into everyday spending. The stablecoin, which is pegged 1:1 to the USD, has grown rapidly since its 2023 launch, reaching its market value of approximately $850 million by mid-2025, which shows a 70% increase from the previous year.

Rise of Cryptocurrency Payments for Remittances

Cryptocurrency is rapidly transforming how the world handles money, creating a new global payment system that works alongside traditional banking. Digital currencies like Bitcoin, Ethereum, and stablecoins are gaining popularity because they offer fast, secure transactions that cross borders effortlessly, without needing banks as middlemen.

This shift is happening because cryptocurrency operates on blockchain technology, which is a transparent digital ledger that reduces costs and processing times, especially for international payments.

Unlike traditional bank transfers that take days and involve multiple fees, crypto transactions can settle in minutes at a fraction of the cost, making them particularly valuable for migrant workers sending money home or businesses paying international partners.

Major financial companies are now embracing cryptocurrency to stay competitive. Payment giants like PayPal and Visa now allow users to buy, sell, and hold cryptocurrencies. Visa has partnered with crypto platforms to let shoppers convert digital assets into regular currency at checkout counters, while JPMorgan Chase has developed its own blockchain system called Onyx for faster settlements.

Smaller payment companies are also joining this trend. Platforms like Stripe and Square have added cryptocurrency payment options, which allow businesses to accept digital currencies from customers.

Stablecoins have also become particularly useful for everyday payments since they do not suffer from the price swings that affect Bitcoin and Ethereum.

Despite this progress, challengers are still out there. Governments around the world are still creating regulations to protect consumers while preventing illegal activities. There are also technical hurdles to handling the massive number of transactions that global adoption would require.

Rajpalsinh is a crypto journalist with over three years of experience and is currently working with CryptoNewsZ. Throughout his journey, he has honed skills like content optimization and has developed expertise in blockchain platforms, crypto trading bots, and hackathon news and events. He has also written for TheCryptoTimes, where his ability to simplify complex crypto topics makes his articles accessible to a wide audience. Passionate about the ever-evolving crypto space, he stays updated on industry trends to provide well-researched insights. Outside of work, gaming serves as his stress buster, helping him stay focused and refreshed for his next big story. He is always eager to explore new blockchain innovations and their potential impact on the global financial ecosystem.