Amdax Plans 1% Bitcoin Treasury Strategy for Euronext Listing

Key Highlights:

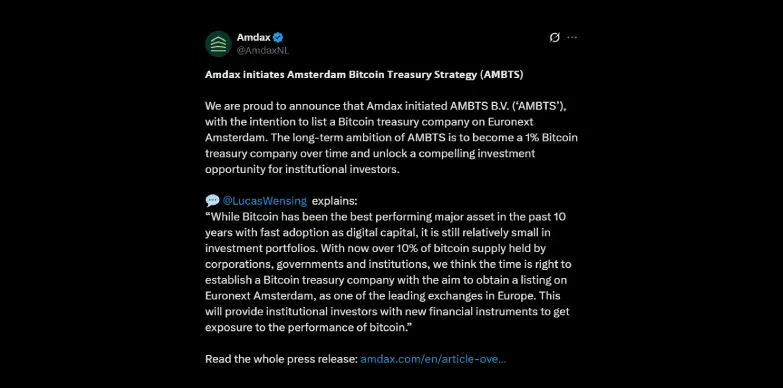

- Amdax has launched Amsterdam Bitcoin Treasury Strategy (AMBTS) to create a Bitcoin treasury.

- AMBTS plans to hold 1% of the total Bitcoin (BTC) supply.

- The initiative will be leveraging strong regulatory compliance and partnerships to provide secure, regulated Bitcoin exposure for institutional investors.

Amdax, one of the Netherland’s leading crypto service providers, has officially launched the Amsterdam Bitcoin Treasury Strategy (AMBTS) to bring in institutional-scale Bitcoin investments to Europe’s financial markets. With the creation of AMBTS B.V., a private limited liability company, Amdax is currently aiming to list the Bitcoin treasury firm on Euronext Amsterdam. This listing will position it as a great investment vehicle for institutional and sophisticated investors that want regulatory-compliant, large-scale exposure to Bitcoin.

Strategic Vision: 1% of Global Bitcoin Supply

The main goal of the company is to hold at least 1% of all BTC in circulation, which is equal to 210,000 BTC. If the firm manages to achieve this goal, it would make AMBTS one of the single largest institutional holders of BTC, supporting its view that BTC, because of its limited supply, strong technology and rising acceptance, deserves a place next to gold, real estate, and government bonds in long-term investment portfolios.

Why Now? Institutional Momentum and Regulatory Readiness

The timing of AMBTS’s launch is no coincidence. Bitcoin has surged up to 32% in 2025, all because of regulatory clarity, a surge in institutional adoption, and high-profile political support for digital assets from key global economies. More than 10% of Bitcoin’s supply is now said to be held by corporations, various governments, and institutions. This highlights that BTC is indeed a credible “digital gold”, hedge against inflation and geopolitical risks.

On the other hand, Europe is experiencing sudden shifts in its regulatory landscape and Amdax has been proactive here as well. Amdax is the first crypto services provider in the Netherlands that has registered with the Dutch Central Bank and is amongst the earliest firms to secure a MiCAR license, complying with the EU’s new Markets in Crypto-Assets Regulation. This regulatory grounding not only allows Amdax to go after such ambitious projects but also reassures that AMBTS is rooted in reliable governance, risk management, and compliance practices.

Euronext Amsterdam Listing: A Regulated Gateway for Institutions

AMBTS is seeking to be listed on Euronext Amsterdam. If their investment vehicle gets listed on Euronext, it will act as a bridge between traditional finance and digital assets. This move also implies that the vehicle has been designed specifically for large, risk-sensitive investors. The exchange’s regulated framework gives institutions access to the Bitcoin market without the operational and custody risks that are typically associated with direct crypto investments.

Also, the listing will make AMBTS as one of the first dedicated Bitcoin European exchange, poised to become a model for similar ventures continent-wide.

Secure Custody and Risk Mitigation

Amdax figured out that institutional investors are concerned about security and hence it has partnered with Custodiex, a UK-based custody services provider known for its quantum-resistance, ISO 27001-certified technology. This partnership will make sure that AMBTS’s BTC holdings are guarded by state-of-the-art cold storage groundwork for a scalable, future-proof treasury platform.

AMBTS vs. MicroStrategy: Realistic Growth and Institutional Optimism

As stated above, Amdax’s AMBTS wishes to hold 1% of the total BTC supply. This number is significant but if you compare it with Strategy’s (formerly known as MicroStrategy) 3% holding, the largest corporate Bitcoin treasury globally, it took around five years to reach where it is today. Looking at AMBTS’s goal, it seems like the company would need approximately 3-5 years to accomplish its goal, given steady growth and favourable market conditions. With its regulated structure and focus on institutional investors, AMBTS offers an optimistic and credible pathway for European institutions seeking regulated exposure to Bitcoin’s long-term value.

Also Read: Citigroup to Embrace Stablecoins and Crypto ETFs as Regulations Ease

Harsh Chauhan is an experienced crypto journalist and editor at CryptoNewsZ. He was formerly an editor at various industries, including his tenure at TheCryptoTimes, and has written extensively about Crypto, Blockchain, Web3, NFT, and AI. Harsh holds a Bachelor of Business Administration degree with a focus on Marketing and a certification from the Blockchain Foundation Program. Through his writings, he holds the pulse of the rapidly evolving crypto landscape, delivering timely updates and thought-provoking analysis. His commitment to providing value to readers is evident in every piece of content produced. With a deep understanding of market trends and emerging technologies, he strives to bridge the gap between complex blockchain concepts and mainstream audiences.