Billionaire Paul Tudor Calls Bitcoin “Digital Gold”

Key Highlights

- Billionaire Paul Tudor has called Bitcoin a digital gold, and it is a very appealing investment

- European Central Bank President Christine Lagarde stated that Bitcoin has no underlying value

- These statements come amid an ongoing intense rally in the cryptocurrency

On October 7, the cryptocurrency community witnessed two contradictory reactions from well-known personalities on the biggest cryptocurrency, Bitcoin.

Bitcoin is like Digital Gold: Paul Tudor

During the interview on CNBC, Paul Tudor, an American billionaire hedge fund manager, praised Bitcoin, comparing it with gold. He said, “Bitcoin…digital gold, that’s obviously very very appealing. I’d want to have positions.”

JUST IN: 🇺🇸 Billionaire Paul Tudor says Bitcoin is “digital gold.” pic.twitter.com/o5p6ZECXfN

— Watcher.Guru (@WatcherGuru) October 7, 2025

His statement comes when BTC continues its upward trend and creates a new all-time high on Monday, after breaking $125,000 mark. However, the cryptocurrency failed to sustain this peak due to massive sell-off pressure and dropped to $123,056 quickly.

This rally in BTC reminds Paul Tudor of 1999’s tech rally. Even he thinks that Bitcoin has stronger fundamentals.

According to him, some factors, like 6% U.S. budget deficit and the Federal Reserve’s renewed are helping the ongoing rally in the cryptocurrency.

Paul also pointed out the current regulatory shift in favor of the cryptocurrency market. Under U.S. President Donald Trump’s pro-crypto administration, the cryptocurrency innovators are finally getting regulatory clarity with frameworks like the GENIUS Act and CLARITY Act.

He mentioned that the generally, the historic price rally comes in the 12 months leading up to a market top. This is why active risk management is important even during strong rallies. When asked which assets are positioned to benefit, Jones singled out gold and Bitcoin.

BTC has No Intrinsic Value: ECB President Christine Lagarde

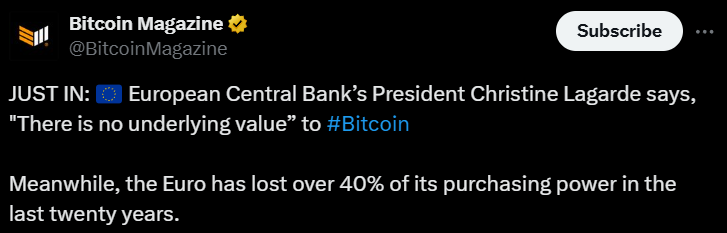

European Central Bank President Christine Lagarde stated that Bitcoin is thriving on speculation and has no “underlying value to Bitcoin.”

(Source: Bitcoin Magazine on X)

Her statement comes amid the weakening position of the Euro as it has crashed dramatically in recent years.

Currently, the global economy is facing turbulence due to the rising debt crisis and inflation problem. Financial institutions and banks are continuously exploring options to bring financial stability. However, many entities are diverting towards the crypto market and investing heavily in BTC by citing its hedge-resistant model.

President Lagarde’s recent comments reaffirm the European Central Bank’s consistently skeptical position on cryptocurrency. The institution maintains that digital assets like BTC come with a risk to financial stability and do not possess the legal standing of conventional currency.

Lagarde described BTC as a highly speculative asset, unsuitable for reliably preserving wealth over the long term.

However, some financial experts contend that this perspective overlooks significant weaknesses within the existing financial framework. The Euro has experienced a substantial loss of purchasing power over the last two decades, which has diminished the value of household savings and weakened public trust in the currency.

When the ECB’s monetary policy is contrasted with BTC’s increasing adoption, it creates an environment ripe for a serious discussion about BTC’s potential as a store of value compared to the Euro’s established use for daily transactions.

Lagarde’s Stance Highlights a Deeper Institutional Concern

The conviction behind Lagarde’s strong statement hints at a broader institutional anxiety over the erosion of monetary control. As Bitcoin gains traction, central banks are finding it more challenging to maintain their traditional authority over money supply and inflation.

The prospect of citizens adopting a decentralized currency inherently questions the foundation of a system built on centrally-issued fiat money.

This dynamic is unfolding as the European Central Bank develops its own digital Euro project, whose public reception remains uncertain. Many view central bank digital currencies as instruments for increased financial surveillance and control, whereas cryptocurrencies are often seen as tools for personal financial sovereignty.

Bitcoin Creates New ATH

On Monday, Bitcoin created a historic milestone once again after reaching new heights at $125,835.92, according to CoinMarketCap. This comes after rising over 33% in a year, thanks to positive regulatory shifts and constant inflows in Bitcoin ETFs. This institutional investment and mainstream adoption of Bitcoin could help BTC push beyond $130,000 in October.

Rajpalsinh is a crypto journalist with over three years of experience and is currently working with CryptoNewsZ. Throughout his journey, he has honed skills like content optimization and has developed expertise in blockchain platforms, crypto trading bots, and hackathon news and events. He has also written for TheCryptoTimes, where his ability to simplify complex crypto topics makes his articles accessible to a wide audience. Passionate about the ever-evolving crypto space, he stays updated on industry trends to provide well-researched insights. Outside of work, gaming serves as his stress buster, helping him stay focused and refreshed for his next big story. He is always eager to explore new blockchain innovations and their potential impact on the global financial ecosystem.