BUZZ ETF Surges, Outperforming Market on Social Sentiment Power

Key Highlights:

- BUZZ ETF outpaced both SPY and ARKK.

- ETF analyst Eric Balchunas highlights the irony between traditional investing wisdom and recent success of the BUZZ ETF.

- The rise of BUZZ shows how AI and social media are shaping modern investing.

In a time when artificial intelligence, internet buzz, and meme stocks usually dominate the market conversations, one of the most surprising winners has been the VanEck Social Sentiment ETF with ticker BUZZ. The fund is currently following a strategy that many experts laughed at in the beginning. The strategy included scanning X (formerly known as Twitter), Reddit, and other sites to figure out and invest in the most talked-about U.S. stocks. Luckily, against the odds, BUZZ has made a strong comeback, beating major market indexes and even some well-known innovation funds over different time periods.

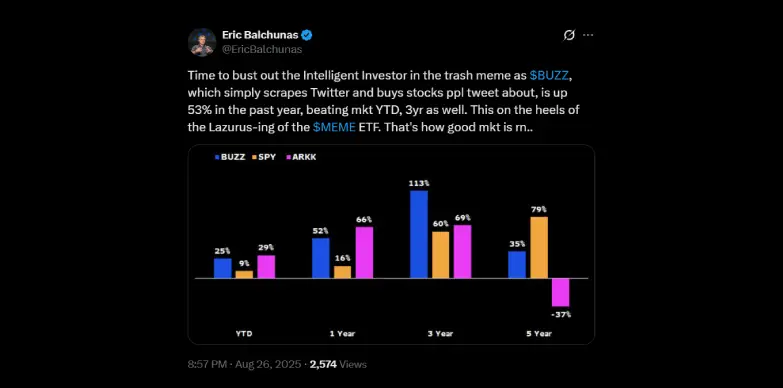

According to new performance data that has been highlighted by Eric Balchunas, a Bloomberg ETF analyst, BUZZ is up by 25% year-to-date (YTD), which is more than doubling the S&P 500’s (a main stock market benchmark) 9% YTD gain. This number also easily outpaces ARK Innovation ETF’s (ARKK) 29% rise. While one-year returns usually fluctuate crazily across funds, BUZZ leads the pack with a 52% jump over the past 12 months, compared to ARKK’s 66% and SPY’s modest 16%.

If you look at the longer timeframes, you can see that interesting numbers show up. In the past three years, BUZZ has gone up by 113%. This number is much higher than the 60% gain of the S&P 500and the 69% gain of ARKK.

Over a period of five years, the results seem to be a little mixed. SPY (which tracks the S&P 500) is up by 79%, BUZZ is up by 35% and ARKK has, however, dropped by 37%. Even so, the fact that BUZZ, an ETF based only on social media chatter, has managed to keep up with market situations which includes COVID, interest rate hikes from Fed, and the boom-and-bust of meme stock, is impressive.

The Irony of Modern Investing

Eric Balchunas also noted the irony in the trend and joked “Time to bust out the Intelligent Investor in the trash meme”. What he meant is that BUZZ’s success is against old-school investing ideas, like Benjamin Graham’s classic focus on company value and fundamentals as BUZZ is winning by following what people have been talking about online.

When this was first launched in 2021, many thought about a fund that is built on hashtags, forums, and memes but the numbers show a strong performance and indicates that this strategy works.

The Second Act of Meme ETFs

Adding more to this buzz is the comeback of other meme-themed ETFs such as the Roundhill MEME ETF ($MEME). This fund was also created to ride the wave of retail traders who first made noise on Reddit’s WallStreetBets and then spread the craze to other social media platforms such as TikTok and Twitter (now known as X). While most of these funds lost the momentum once the original meme-stock frenzy cooled off, their recent rebound shows that today’s market environment might once again be working in their favor.

The BUZZ ETF is a clear example of how market sentiment has turned into something that can help you trade in reality. Every day, it scans millions of online posts and finds companies that keep getting a significant amount of attention. After this, it builds a portfolio around them. Because of this method, BUZZ usually ends up holding big positions in popular tech companies, fast growing stocks, and brands that are culturally relevant. These are the exact kinds of stocks where retail excitement can create momentum far bigger than what traditional valuation methods would predict.

Sentiments as the New Fundamental

For investors who are experienced, BUZZ raises big questions about how long sentiment-driven strategies can actually last. Critics also warn that it may shine in bull markets but will struggle badly during the downturns, just like ARKK did. Supporters, on the other hand, argue the opposite, and quote that sentiment itself is a core market driver.

BUZZ’s rise indicates that sentiments clearly move markets as much as earnings or rates. By packaging online attention into an investable fund, BUZZ is making even skeptics take notice. As Balchunas quipped, it’s no longer just fundamentals, it is the voice of millions steering the charts.

Also Read: Bitcoin Falls Below $110,000, Strategy Purchases 3,081 BTC

Harsh Chauhan is an experienced crypto journalist and editor at CryptoNewsZ. He was formerly an editor at various industries, including his tenure at TheCryptoTimes, and has written extensively about Crypto, Blockchain, Web3, NFT, and AI. Harsh holds a Bachelor of Business Administration degree with a focus on Marketing and a certification from the Blockchain Foundation Program. Through his writings, he holds the pulse of the rapidly evolving crypto landscape, delivering timely updates and thought-provoking analysis. His commitment to providing value to readers is evident in every piece of content produced. With a deep understanding of market trends and emerging technologies, he strives to bridge the gap between complex blockchain concepts and mainstream audiences.